NTKN Jan 17th: Population, tech, currency, data & influence

Looming demographic impacts on Asian economies, another angle on China's tech control, a look at the global reserve currency, data localization gets it wrong, and SE Asia's foreign influence risks.

The end of East Asia’s demographic dividend

China’s gov’t buys ‘golden shares’ in Alibaba & Tencent

US dollar: Under threat as global reserve currency?

The false promises of data localization and control

Download: ‘Malign interference in Southeast Asia’

1. The end of East Asia’s demographic dividend

“Japan’s demographic present is the near future for a number of East Asian economies. South Korea has the lowest fertility rate in the world—at 0.9 births per woman. But other East Asian countries aren’t far behind. Hong Kong and Singapore are at 1.1 births, Thailand 1.5, and China at 1.7—all considerably below the ‘replacement’ rate of 2.1 births per woman. And according to UN forecasts, working age populations are set to shrink as the number of retirement-age people rapidly expands.”

“As in Japan, there is a role for raising retirement rates, faster automation, and higher women’s labor force participation to help fill the worker gap across the region, but Japan’s experience also demonstrates these approaches will be inadequate to the scale of the problem.”

And:

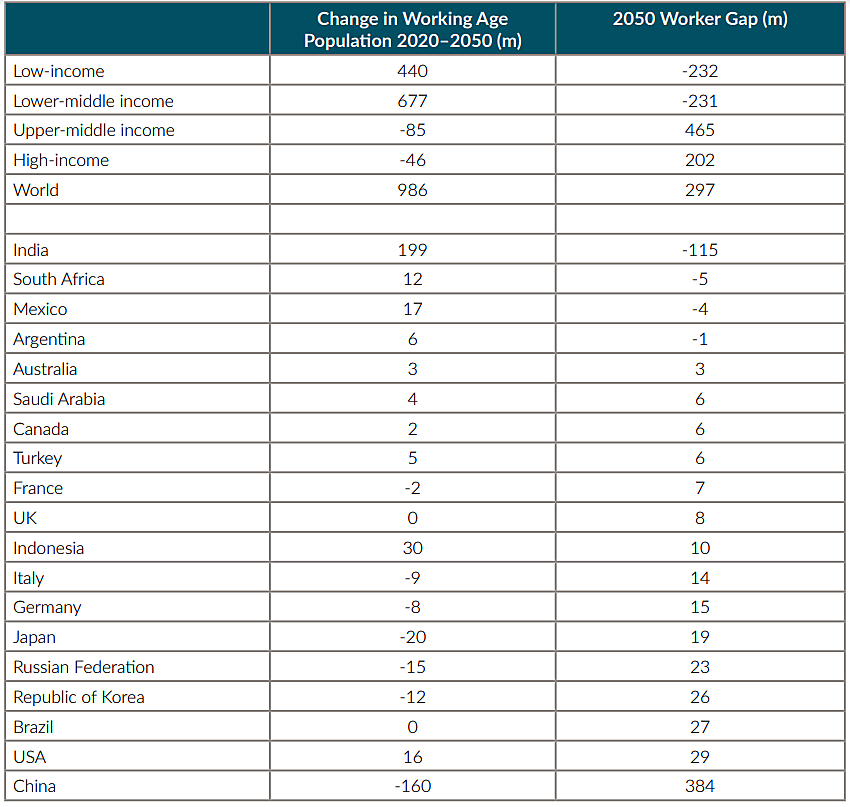

“In high income countries, the population aged 20-64 will be 46 million smaller in 2050 than 2020. In upper-middle income countries there will be 85 million fewer potential workers.”

“Looking at the number of extra working age people that would be required to keep the overall dependency ratio the same given forecast populations under 20 and over 64, that ‘worker gap’ adds up to 202 million people in high income countries and 465 million in upper-middle income countries (Table 2). China alone will see a worker gap of 384 million connected with a working age population that will shrink by 160 million between 2020 and 2050 as the population of retirement-age workers expands.”

2. Chinese gov’t takes ‘golden shares’ in Alibaba, Tencent

“Within China the stakes are known as “special management shares” and since 2015 have become a common tool used by the state to exert influence over private news and content companies.”

And:

“That share structure, which in theory allows the government to nominate directors or sway important company decisions, could grant officials a tool to influence the industry over the longer term.”

3. US Dollar: Under threat as global reserve currency?

“There are three core reasons that the dollar will largely retain its dominant position, much to the chagrin of America’s adversaries…The first is liquidity….Second, desirable reserve currencies need to be dependably tradable…Third, the complexity of recreating the whole ecosystem in a different currency renders a regime change unlikely…”

And:

“As we document in a recent IMF working paper, the reduced role of the US dollar hasn’t been matched by increases in the shares of the other traditional reserve currencies: the euro, yen, and pound. Moreover, while there has been some increase in the share of reserves held in renminbi, this accounts for just one quarter of the shift away from dollars in recent years, partly due to China’s relatively closed capital account. Moreover, an update of data referenced in the working paper shows that, as of the end of last year, a single country—Russia—held nearly a third of the world's renminbi reserves.”

4. The false promises of data localization and control

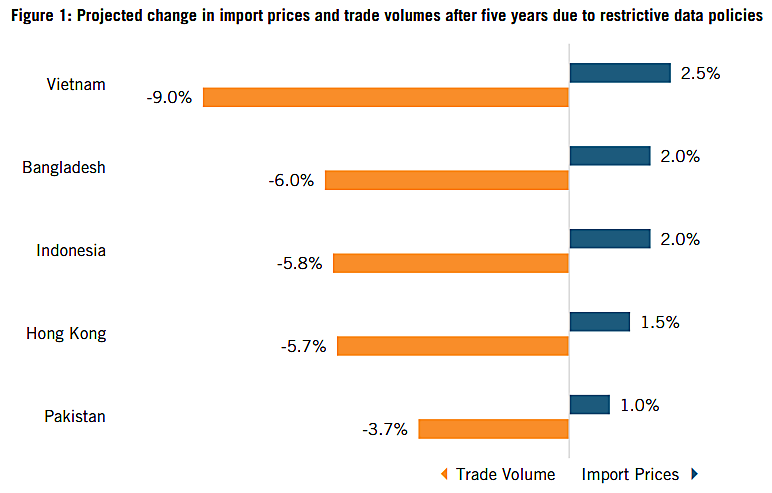

“Restricting data flows has a statistically significant impact on a country’s economy—sharply reducing its total volume of trade and increasing import prices for downstream industries that increasingly rely on data.”

“Data localization impacts the entire economy. ITIF’s model shows that trade volumes decrease in line with imports. Since they are used as inputs in domestic production, higher import costs also reduce exports.”

“After five years, restrictive data policies will reduce Bangladesh’s volume of trade by 6 percent, Hong Kong’s by 5.7 percent, Indonesia’s by 5.8 percent, Pakistan’s by 3.7 percent, and Vietnam’s by 9 percent.”

5. Download: Malign interference in Southeast Asia

“Singapore has responded to sharp power and foreign interference threats in a variety of ways. Intent on reiterating its ‘Chinese’ identity distinct from that of China, the country went as far as to build the $110-million Singapore Chinese Cultural Centre, which serves as a clear rejection of Xi [Jinping] vision.”

“In the Philippines and Indonesia, the picture is far more complicated. On the one hand, there is the risk of ‘pledge trap’ – luring elected leaders in key Southeast Asian countries through pledges of (rather than realised) large-scale investments, which tend to generate positive headlines at home.”